Freelancer Tax Tips for Seasonal Work

Navigating the world of self-employment taxes can feel overwhelming, particularly for seasonal freelancers like yourself. As you juggle various projects and deal with fluctuating incomes, grasping your tax obligations becomes essential.

This article offers key tips for managing your taxes effectively from tracking your income and expenses to maximizing deductions and sidestepping common pitfalls.

Whether you re just starting your freelancing journey or you ve been at it for a while, these tips will give you the confidence you need to approach tax season with clarity. Dive in to ensure you re fully prepared for this crucial aspect of your freelance career!

Contents

- Key Takeaways:

- Tax Tips for Seasonal Freelancers

- Tracking Income and Expenses

- Unlock Your Deductions as a Freelancer!

- Filing Taxes as a Freelancer

- Avoiding Common Tax Mistakes

- Frequently Asked Questions

- What is considered seasonal work for freelancers?

- Do I pay taxes on seasonal freelance income?

- What tax deductions can I claim as a freelancer for seasonal work?

- How can I stay organized and prepared for tax season as a freelancer with seasonal work?

- Do I need to file taxes in every state I work in as a freelancer with seasonal work?

- What should I do if I receive a 1099 form for my seasonal work as a freelancer?

Key Takeaways:

- Understand self-employment taxes and their impact on seasonal work income, including state taxes and local taxes.

- Effective record-keeping is crucial for tracking income and expenses to maximize deductions.

- Know important deadlines and forms to file your taxes accurately and efficiently.

Understanding Self-Employment Taxes

Understanding self-employment taxes is essential for freelancers who are navigating the intricate world of tax compliance and financial management. As a self-employed individual, you have a range of tax obligations that differ significantly from those of traditional employees.

These include self-employment taxes, which contribute to Social Security and Medicare, alongside both federal and state taxes that require precise reporting to the IRS. You will typically use Form 1040 and Schedule C to report your freelance income and business expenses.

Being well-versed in these forms and tax strategies can profoundly influence your financial well-being for years to come.

Self-employment taxes encompass not just income taxes but also contributions to Social Security and Medicare, which can impact your net earnings. Ensure you re accurately deducting allowable business expenses to lower your taxable income effectively.

Misreporting can lead to penalties or audits, underscoring the necessity of meticulous record-keeping.

Various tax forms, including Schedule SE for calculating self-employment tax and Form 1099 for income reporting, are critical for maintaining compliance. By grasping these obligations, you can take advantage of deductions, prepare for quarterly taxes, and implement financial strategies that pave the way for long-term stability and success.

Tax Tips for Seasonal Freelancers

Tax tips for seasonal freelancers can greatly elevate your financial management, ensuring compliance while maximizing deductions. Seasonal work tends to bring fluctuating income and distinct tax challenges.

Understanding how to meticulously track client payments and accurately report your income is vital, especially when it s time to file your annual tax return.

As a seasonal freelancer, consider your estimated taxes and how they influence your financial planning throughout the year. For a deeper understanding, check out resources on navigating quarterly taxes as a freelancer. Investing in this knowledge can make a significant difference in your financial health.

Key Considerations for Seasonal Work

When you dive into seasonal freelance work, think about how your income will fluctuate and the impact client payments can have on your finances. Seasonal roles present unique challenges, including managing irregular income streams and grasping the tax implications of your earnings.

If you re working from home, you have the added advantage of various business expenses that may be deductible, helping to optimize your overall tax burden.

Navigating these financial ebbs and flows calls for strategic planning. Create a budget that mirrors your seasonal income patterns, allowing you to allocate funds wisely during leaner months.

Keep precise records of client payments; utilizing invoicing software can simplify this task and ensure that no payment goes unnoticed.

By capitalizing on deductible expenses, such as home office costs and equipment purchases, you can significantly lower your taxable income and enhance your financial standing.

Understanding these financial dynamics will better equip you to prepare for the inevitable ups and downs of seasonal freelance work.

Start organizing your records today, and take control of your freelance finances! Knowing how to handle tax audits as a freelancer can also help you stay prepared.

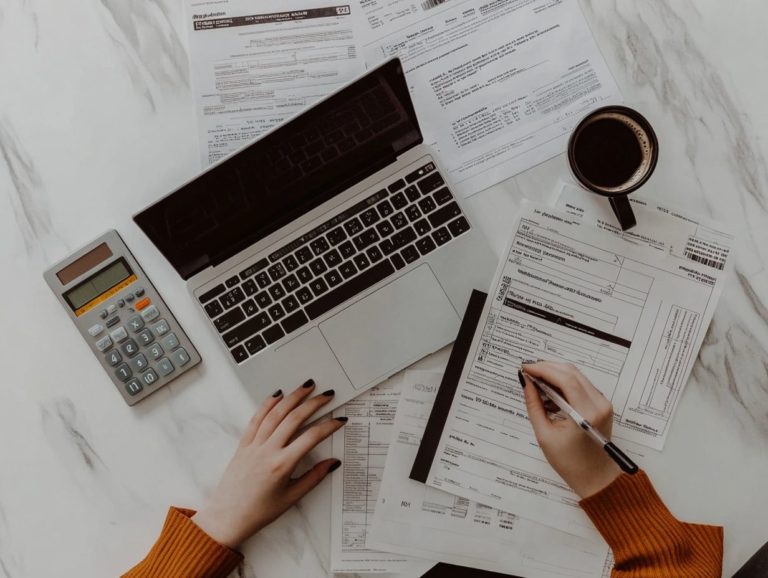

Tracking Income and Expenses

Tracking your income and expenses is crucial for maintaining your financial health and ensuring compliance with tax regulations as a freelancer. Effective record-keeping empowers you to monitor your cash flow, manage client payments seamlessly, and spot potential business expenses that could qualify for deductions.

By leveraging accounting software, you can streamline this process, automate your financial tracking, and guarantee that every transaction is meticulously recorded for tax filing. This approach saves you valuable time and enhances your peace of mind when tax season rolls around.

Effective Record-Keeping Strategies

Implementing effective record-keeping strategies is essential for you as a freelancer, enabling you to streamline your financial management and simplify your tax filing processes. By utilizing accounting software, you can efficiently track your income and expenses, ensuring that every financial transaction is accurately documented.

This practice not only simplifies tax preparation but also allows you to identify deductible business expenses, potentially reducing your tax burden when it s time to file your annual return. Keeping organized records provides you with valuable insights into your spending habits and revenue streams, empowering you to make informed financial decisions.

By leveraging features like automatic categorization, invoicing, and reporting in your accounting software, you can easily manage your cash flow and budget for future projects. Producing precise financial reports not only helps you meet your tax obligations but also enhances your credibility when seeking loans or attracting clients.

By implementing these strategies, you can transform your record-keeping into a powerful tool for growth and financial stability.

Unlock Your Deductions as a Freelancer!

Getting the most deductions possible is a potent strategy for freelancers aiming to optimize tax liabilities and elevate their financial well-being. As a self-employed individual, you have access to many types of deductions related to your business expenses, which can notably reduce your taxable income.

Understanding what qualifies as deductible can greatly affect your tax filings. This knowledge enables you to retain more of your hard-earned money while also understanding the implications of Federal Taxes.

Common Deductions and How to Claim Them

Freelancers often miss out on common deductions that could significantly reduce their tax liabilities. It’s crucial to recognize these deductions, which typically encompass business expenses like software subscriptions, office supplies, and home office costs.

Mastering the art of claiming these deductions can not only streamline your tax filing process but also ensure you’re not leaving any money on the table. You should maintain meticulous records of your expenditures, categorizing them for easy reference come tax season.

For example, tracking travel expenses like mileage and lodging can further enhance your deductions. Don t forget to keep receipts and invoices; they serve as essential evidence to back up your claims.

Utilizing accounting software can simplify this entire process, allowing you to generate reports that highlight deductible expenses throughout the year. As you navigate these intricacies, taking proactive steps to document and report your expenses can lead to a smoother filing experience and potentially increase your refunds.

Filing Taxes as a Freelancer

Filing taxes as a freelancer can feel like traversing a labyrinth of intricate regulations and numerous forms required by the IRS. At the heart of this process are Form 1040, your main tax form, and Schedule C, which reports your business income and expenses.

Submitting these forms on time is essential to avoid penalties and maintain compliance with both federal and state tax laws. Being acutely aware of deadlines is not just advantageous; it s vital for your financial health!

Important Deadlines and Forms to Know

Staying aware of important deadlines and the necessary forms is essential for you as a freelancer. This helps ensure a smooth tax filing process. Key forms like Form 1040 for your individual income tax and Schedule C for reporting profit or loss from your business are vital to your success.

Meeting filing deadlines, such as the April 15 due date for your annual tax return, is crucial to avoid penalties and to get your refund faster!

Keep a close eye on estimated tax payments, which typically come due quarterly to steer clear of underpayment penalties. The due dates for these payments are April 15, June 15, September 15, and January 15 of the following year. It s wise to mark your calendar and stay proactive. Missing these deadlines can cost you money don’t let that happen!

To stay organized, consider using digital tools like calendar reminders and task management apps to track your deadlines. A dedicated folder for your tax documents throughout the year can streamline the preparation process. Additionally, implementing freelancer tax strategies can make for a smoother filing experience and give you the peace of mind you deserve.

Avoiding Common Tax Mistakes

Avoiding common tax mistakes is crucial for you as a freelancer. This helps not only to follow the rules but also to minimize potential penalties. Many freelancers inadvertently stumble into pitfalls like misreporting income, overlooking valuable deductions, or neglecting to make estimated tax payments.

By being aware of these typical tax blunders, you can adeptly navigate the complexities of your tax obligations. Incorporating essential tax tips for creative freelancers ensures a smoother filing process with the IRS and safeguards your financial well-being.

Tips for Accurate and Efficient Tax Filing

Accurate and efficient tax filing can save you time and money while ensuring you stay on the right side of the IRS. Implement strategies such as maintaining organized records, utilizing accounting software, and seeking the expertise of tax professionals to streamline your tax filing process.

Understanding your deductions and knowing how to report your income accurately is essential for a seamless tax season. Start by establishing a reliable method for tracking your expenses and income, whether that’s through spreadsheets or dedicated accounting apps. For new freelancers, following tax planning tips can make a significant difference. Regularly updating your records not only reduces stress when tax season rolls around but also maximizes your eligible deductions.

Consider popular software tools like QuickBooks or FreshBooks to simplify your financial tracking. These tools can even generate valuable reports for better insights into your finances.

Since tax regulations can shift, consulting with a tax professional is incredibly beneficial. They offer personalized guidance to ensure you don t overlook anything that could minimize your liabilities and help you avoid potential audits.

Frequently Asked Questions

What is considered seasonal work for freelancers?

Seasonal work for freelancers refers to any type of work available only during certain times of the year, such as holiday or summer jobs. It can also include short-term projects or events that occur annually.

Do I pay taxes on seasonal freelance income?

Yes, as a freelancer, you are responsible for paying taxes on all income earned, including from seasonal work. This includes both federal and state taxes, as well as self-employment taxes.

What tax deductions can I claim as a freelancer for seasonal work?

As a freelancer doing seasonal work, you may be eligible for several tax deductions, including:

- Business expenses

- Home office deductions

- Travel expenses related to your work

It is important to keep detailed records and consult with a tax professional to ensure you are claiming all eligible deductions.

How can I stay organized and prepared for tax season as a freelancer with seasonal work?

Keep track of all income and expenses from your seasonal freelance work. This includes saving receipts and invoices.

Use accounting software to streamline your finances. Set aside a portion of your income for taxes throughout the year. This simple step can save you from last-minute surprises!

Do I need to file taxes in every state I work in as a freelancer with seasonal work?

If you work in multiple states as a freelancer, you may need to file taxes in each state where you earned income. This requirement depends on each state’s tax laws and regulations.

Research and talk to a tax expert to make sure you meet all tax filing requirements.

What should I do if I receive a 1099 form for my seasonal work as a freelancer?

If you receive a 1099 form an IRS document reporting your income for your seasonal freelance work, it means the company has reported your earnings to the IRS.

Include this income on your tax return and pay any necessary taxes. Keep a copy of the 1099 for your records.