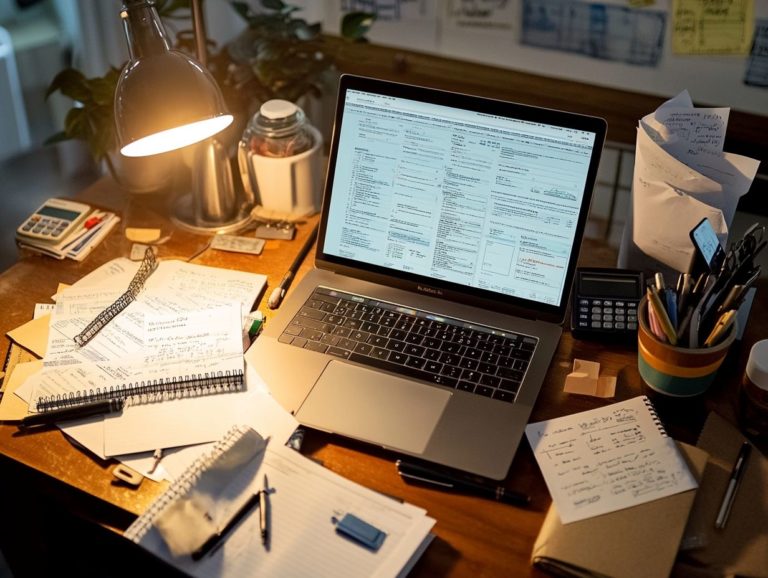

Freelancer Tax Tips for Artists and Creatives

Freelancing offers a rewarding journey, yet the tax landscape can often feel like a daunting maze, particularly for freelance artists and creative thinkers like you. Grasping which taxes you need to pay, keeping track of important deadlines, and maximizing tax deductions tailored to your unique work are all vital components of your financial success. This…