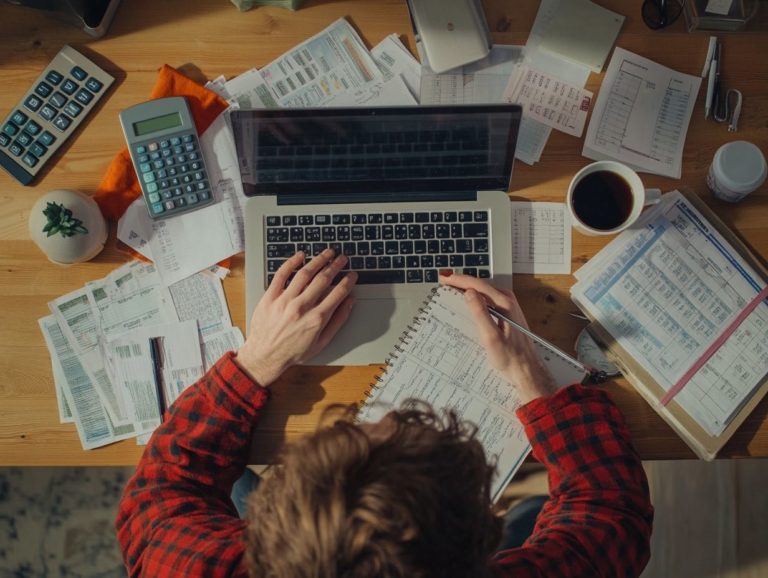

What is the Freelancer’s Guide to Managing Debt?

This guide for freelancers explores the common types of debt you may encounter and how these debts can impact your finances. It provides practical steps to manage and avoid debt, including creating budgets and selecting repayment strategies. The guide will also help you identify when to seek professional assistance. Key Takeaways: Understand the types of…